Sustainable Energy

Ambri’s Better Grid Battery

A tiny startup called Ambri wants to transform our energy system with massive liquid-metal batteries.

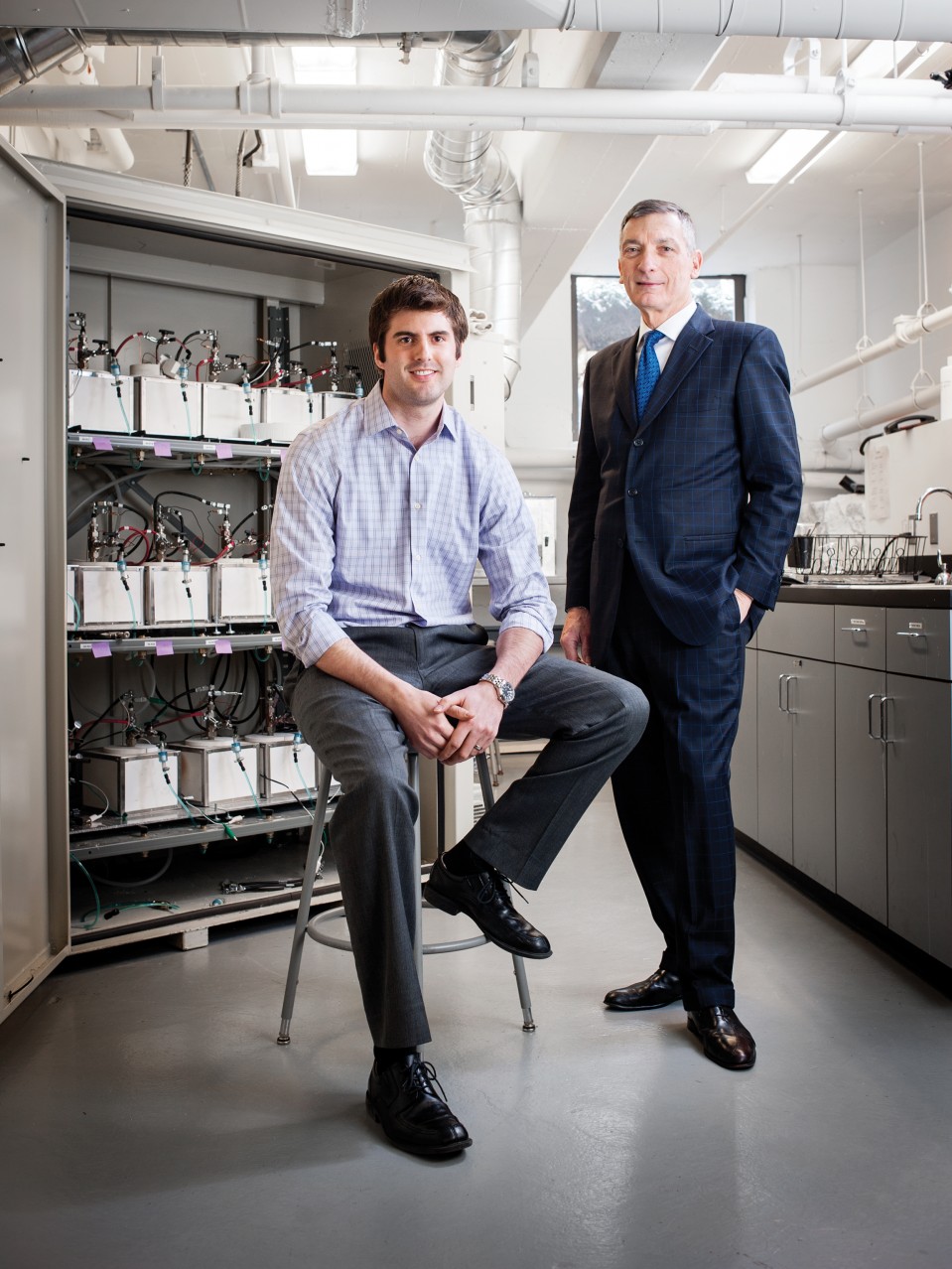

Standing next to the Ping-Pong table in the offices of the battery startup Ambri, chief technology officer David Bradwell needs both hands to pick up what he hopes will be a building block for a new type of electricity grid. Made of thick steel, it’s a container shaped like a large round cake pan, 16 inches in diameter. Inside it are two metal pucks and some salt powder; a round plate has been welded to the top to make a 100-pound battery cell.

By stringing together a number of these large cells, Ambri plans to make huge batteries, as big as 40-foot shipping containers. It’s not only their size that makes them novel: the chemistry in Ambri’s technology is different from any other currently used in batteries. When the cell is heated to around 500 °C, the disks and powder inside—the battery’s electrodes and electrolyte, respectively—will melt. The result is a battery whose components are all liquid. Conventional rechargeable batteries have solid electrodes that degrade with use, but a battery with only liquid parts could last for years without losing much of its energy storage capacity. The molten materials can also operate at much higher current densities than solids, and for longer periods of time.

Ambri cofounder Donald Sadoway, a professor of materials chemistry at MIT, conceived of the liquid-metal cell as a way to build a grid battery that could store many hours’ worth of energy from solar and wind power at very low cost. Because a stationary battery intended to store power for the grid wouldn’t have to be lightweight like the batteries in our laptops, cars, and flashlights, he was free to depart dramatically from the chemistry that powers those devices. The result is a battery that’s made from abundant, inexpensive materials in a simple production process. It can safely handle large currents and deliver power in quick bursts or for an extended period.

If Ambri or anyone else can make grid storage cheap and dependable, it will change the way we get electricity. Because the output of wind and solar farms is intermittent, these renewable sources alone can’t reliably power the entire grid, or even most of it. Grid operators need to ensure a steady balance between the power being consumed and the amount being generated. The system must be able to meet peak demand, which typically occurs when people turn on their air conditioning on hot summer days. That means wind and solar farms are typically backed up with natural-gas plants that can quickly add to the electricity supply.

The ability to bring in stored power when needed would mean that some of those fossil-fuel power plants could be closed and new ones wouldn’t have to be built. But so far we have no good all-purpose way to store energy for the grid. Today, 99 percent of grid storage takes the form of “pumped hydro”—water is pumped uphill to a reservoir and released to turn a generator when energy is needed. This low-tech method is efficient, and it’s cheap over the long term, but it’s limited to places with mountains and readily available water. As a result, it provides less than 1 percent of the power capacity in the United States on a given day, according to Mark Johnson, director of the grid storage program at the Department of Energy’s ARPA-E research agency.

Dozens of companies are developing new energy storage devices, including various types of giant batteries, large spinning cylinders called flywheels, and even compressed-air storage tanks. But so far none of these approaches are cheap enough to be competitive. Depending on its size, a pumped-hydro plant can deliver power for tens of hours at a cost of about $100 per kilowatt-hour. Grid-level batteries can cost 10 times that, which is why there are just a few hundred megawatts of battery power on the grid—less than the amount contributed by one full-size power plant.

Ambri is betting that by using cheap materials and a simple battery design with no moving parts, it can deliver reliable bulk energy storage for well below $500 per kilowatt-hour. That’s still more expensive than pumped hydro, but since batteries can be placed nearly anywhere, Ambri thinks its technology can be the most economical choice for many applications.

“One metric matters more than anything else on the grid,” says Johnson. “It’s cost, cost, cost.”

Shot Glasses

When Sadoway first considered grid storage in 2005, he looked to aluminum smelters for inspiration. These massive machines, which can stretch to more than 200,000 square feet, use huge amounts of electricity to extract aluminum from molten aluminum oxide through electrolysis. Sadoway, who is trained as a metallurgist, realized that smelting could provide a template for a rechargeable battery that tolerates the current levels needed for the grid. “I looked at that and said, Wow, that looks like half of a battery! And it’s big, it’s scalable, and it’s cheap,” he says.

After hitting upon the idea of the liquid-metal battery, Sadoway searched for the perfect electrodes: he ended up choosing magnesium and antimony because they are cheap and separate naturally when in liquid form, the lighter magnesium rising to the top. A liquid-salt electrolyte rests between the magnesium and antimony electrodes, creating a cell with three layers.

When the battery is called upon to deliver power to the grid, magnesium atoms from the top layer—the anode—give off electrons. The resulting magnesium ions travel through the electrolyte and react with the antimony, forming an alloy and expanding the bottom layer of the cell—the cathode. When the battery is charging, it acts like the smelter, liberating the magnesium from its alloy and sending it back through the electrolyte to rejoin the magnesium electrode. The intense flow of current generates the heat used to keep the metals in a molten state. (Ambri has switched to cheaper metal alloys and a salt mixture, but the chemistry works the same way.)

In 2007, when Bradwell was a student in Sadoway’s lab, he used the magnesium-antimony technology to make an experimental battery with about the diameter of a shot glass. By 2009 it had attracted nearly $11 million in research funding from ARPA-E and the French oil company Total. The next year, Sadoway and Bradwell created a company called Liquid Metal Battery Corporation; they then secured seed funding from Bill Gates and Total.

The founders expected the technical work to take longer than the five to seven years that venture capitalists are typically willing to wait before cashing out, so at first they didn’t take money from such investors as many other clean-tech startups had done. By the summer of 2011, though, it was time to build a product. Sadoway recruited a new CEO, Philip Giudice, who helped secure a $15 million round of investment led by Khosla Ventures. The company changed its name to Ambri—based on the name of Cambridge, where the technology was invented.

At least at first, Ambri wants to avoid working with electric utilities, says Giudice, a former Massachusetts state energy official: utilities are conservative and have little financial incentive or regulatory pressure to try out new technologies. Instead, it will initially target military bases and other facilities willing to pay for backup power, such as data centers. These applications are not a huge market, but they will help demonstrate and test the battery.

Later this year, the company plans to make a refrigerator-size module by stacking hundreds of hockey-puck-size cells and wiring them in series. By 2014, the researchers expect, 80 of those modules will be packed together in a full-scale commercial prototype that will generate 500 kilowatts and store two megawatt-hours—enough to power 70 U.S. homes for a full day.

Even after that prototype is up and running, Giudice says, Ambri still plans to avoid the complex, regulation-heavy world of utilities in favor of independent power producers, companies that develop and own energy projects. In west Texas, for example, there’s often a surplus of wind energy at night, when demand and price are lowest. Battery storage would let a wind energy developer provide that power at peak times and earn more money. Another attractive early market is in cities where batteries could be more cost-effective than adding new power lines to meet peak demand for electricity, Giudice says.

If all goes as hoped, Ambri will be able to demonstrate its batteries in multiple installations and show utilities that the technology is low risk, Giudice says. At that point, the company can approach utilities and the state regulators that approve investments in grid equipment. A fully realized utility storage market could be worth billions of dollars in five to 10 years.

The Money

Holding up one of the original shot-glass-size cells next to progressively larger ones—four inches, six inches, and the hefty 16-inch cell—Bradwell shows how far his team has come. But Ambri’s researchers now face the challenge of scaling the liquid-metal battery up to industrial size. Among other tasks, they must design airtight seals on the cells and create a thermal management system that makes sure the heat given off by charging and discharging is enough to keep the components liquid. The group is still determining the individual size that will minimize the fabrication cost, but the cells will be square, between four and 16 inches per side, and about two inches tall.

Ambri has enough money to build its first prototypes. But scaling up production will require more capital at a time when the financing environment for clean-tech companies is far from auspicious. Spooked by poor returns, a series of well-publicized bankruptcies, and the expense of building manufacturing capacity, many venture capitalists have abandoned clean tech, leaving few financing options.

The financing hurdles are particularly high because grid storage startups are taking on big technical challenges in an industry that barely exists. “Venture capitalists like to take either technology or business risk. Some people can take both, but most don’t,” says Bilal Zuberi, an investor at General Catalyst Partners, who has invested in a startup developing grid storage technology based on compressed air. In its next round, Ambri intends to go after investors from the power industry, hoping that companies such as General Electric, ABB, and Siemens can provide not only money but also credibility and expertise in manufacturing and marketing. But even if Ambri’s engineering is flawless and the company secures all the money it needs, it will face the same obstacle confronting so many other alternative energy companies: cheap natural gas. Since natural gas has become the preferred fuel for power generation in the United States, the price that any grid storage technology must meet to be competitive has fallen much lower.

The most significant factor in Ambri’s favor may ultimately be the creaky state of the grid itself. The massive outages caused by Hurricanes Sandy and Irene painfully exposed how vulnerable the power system is, leading politicians and the public to demand solutions. Grid storage could add much-needed resilience and flexibility, providing backup power to buildings and even communities while allowing grid operators to smooth out fluctuations in power supply. Some of the large, centralized power plants that must now be maintained to make sure supply can meet demand would no longer be needed.

Realizing this vision of an electricity system buffered by hundreds of large batteries will take many years, and it will mean upending the status quo in the electric power industry. That’s no easy task. But Ambri believes its battery offers a way to begin taking it on.