Intelligent Machines

Is Facebook Worth It?

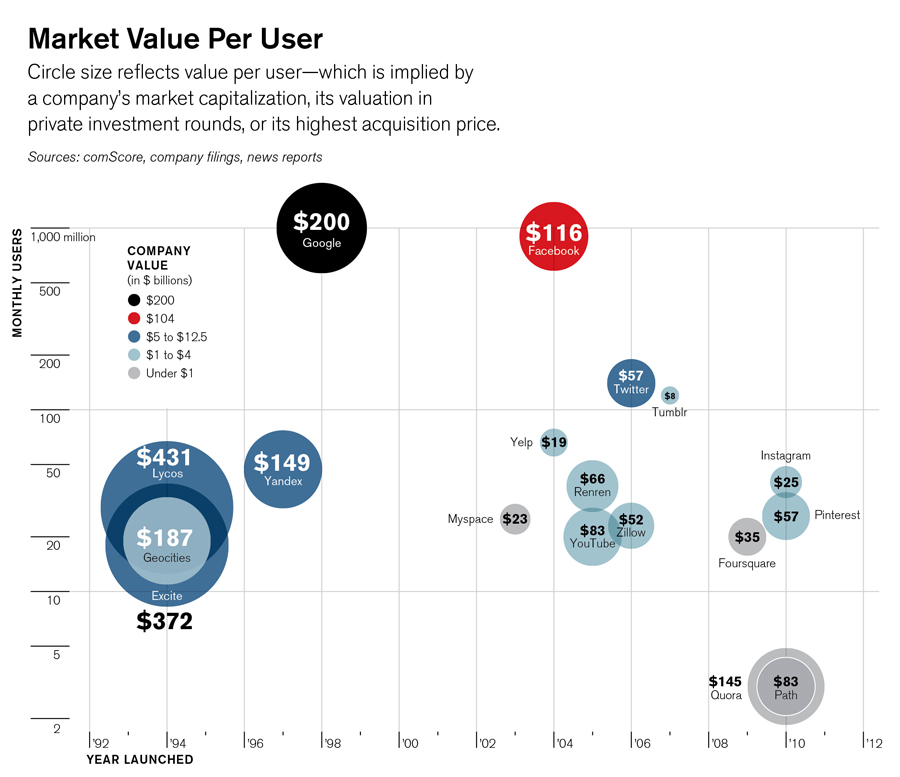

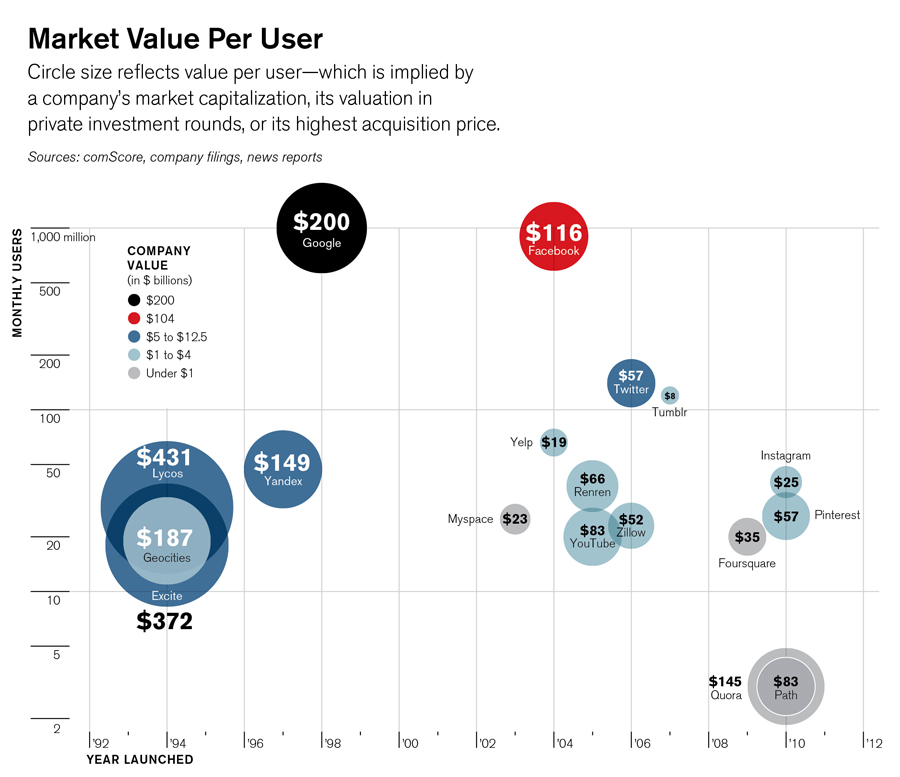

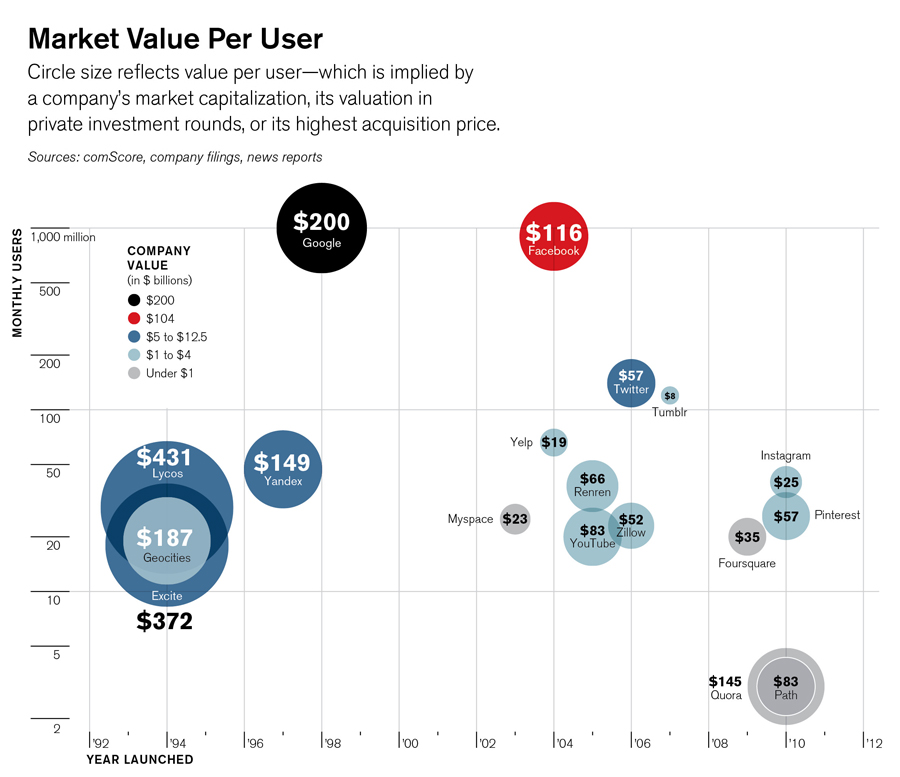

Estimates of the historical value of a user put the IPO hype in perspective.

When Facebook went public, the company was valued at $104 billion, an astonishing figure for an Internet company. Was the figure preposterously high? That depends on how you look at it. The value in Facebook lies in its enormous audience—901 million people every month who are potential viewers of advertisements and buyers of virtual goods. So you could think of Facebook this way: it was worth about $116 for every user it has. On that basis, the company wasn’t being valued as highly as Google ($200 per user) or even the question-and-answer service Quora ($145). This metric also reveals that investors are much less optimistic that Twitter (worth less than $60 per user) or Tumblr (about $8) will profit handsomely from their very large audiences.

Another reason this metric is useful: it indicates that for all the hype around Facebook and its kin, the situation isn’t as hyperbolic as it was in the dot-com boom. Remember Excite, one of the first Web portals? It and its 18 million users were worth as much as $6.7 billion—$372 per user—to the @Home Network in 1999. The next year, Lycos was valued as highly as $12.5 billion, or $431 per user. It might be of little solace that valuations aren’t as inflated as they were 12 years ago, but at least today, unlike then, there is a sizable amount of Internet ad revenue to vie for.

This article was updated on May 22 to reflect the peak value for Lycos, rather than its closing acquisition price.

Advertisement