Blockchain

Understanding digital assets

Why blockchain technology matters and what will come next.

Karl T. Muth is CEO of FRST Corporation, a venture-backed blockchain analytics company headquartered in Chicago. Muth took an interest in blockchain technology early on and made his first investments in blockchain companies in 2016. He shared with MIT Technology Review Insights why blockchain technology matters, how investors are thinking about digital assets today, and what to expect from the future of this space.

Much has been written in recent months about the differences between digital and traditional assets. What do you see as the unique attributes of digital assets as compared to traditional assets?

The key differentiators, in my view, have to do with history, identity, and transparency. By that, I mean when it happened, who did it, and what happened with whom. Unlike traditional assets, digital assets like tokens move around networks with a history that is inexorably intertwined with the movement itself—recordation (the process of putting something in official records) is not optional and redaction is not possible.

Aren’t public markets already relatively transparent? What is special about blockchain’s transparency?

It’s true that public equities markets, for instance, are relatively transparent. But relative to blockchain markets, they are opaque in many ways.

There is no way for me to ask for a list of million-dollar brokerage accounts in traditional markets, or to ask for a list of accounts holding Enron stock on January 11, 2002 when trading was halted. These are costly, exotic, forensic tasks in traditional markets.

Meanwhile I can create a list of every million-dollar digital asset wallet (a unique address used to send and receive value on a blockchain network), or every wallet that interacted with the Mt. Gox exchange in the month prior to February 24, 2014 when trading on that exchange was suspended.

This means a trader can achieve a level of knowledge, transparency, and insight around the behaviors of exchanges, miners, and other traders that is impossible to accumulate in the traditional asset environment.

What are some of the most compelling use cases for blockchain technology?

I’m hesitant to place bets around use cases—it feels like being in 1890, about a decade after the modern incandescent lightbulb’s genesis and asking, “So how will electric light be used?” Replacing lanterns on carriages and electrifying railroad signals might have been obvious, but touch-screen laptops were unimaginable.

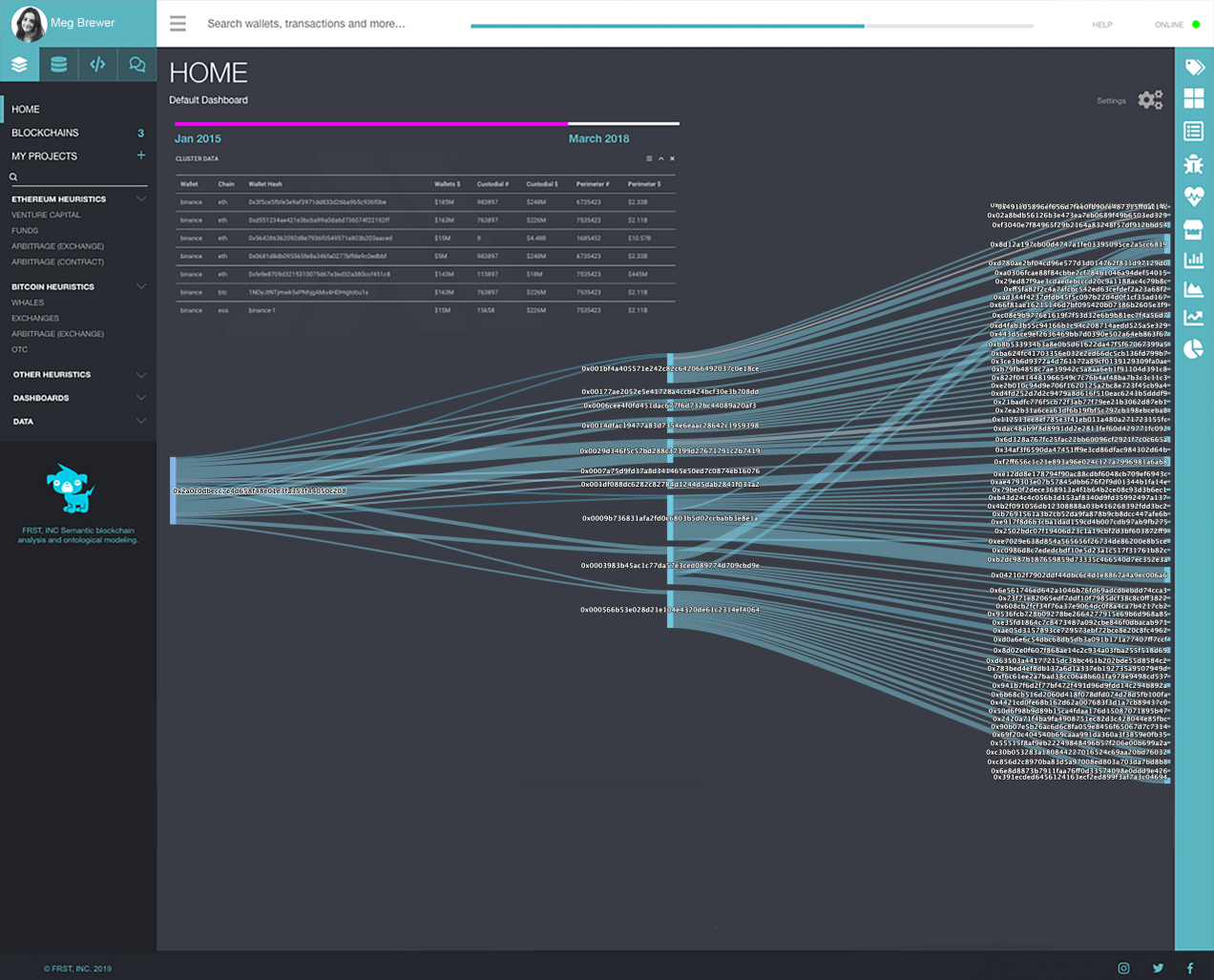

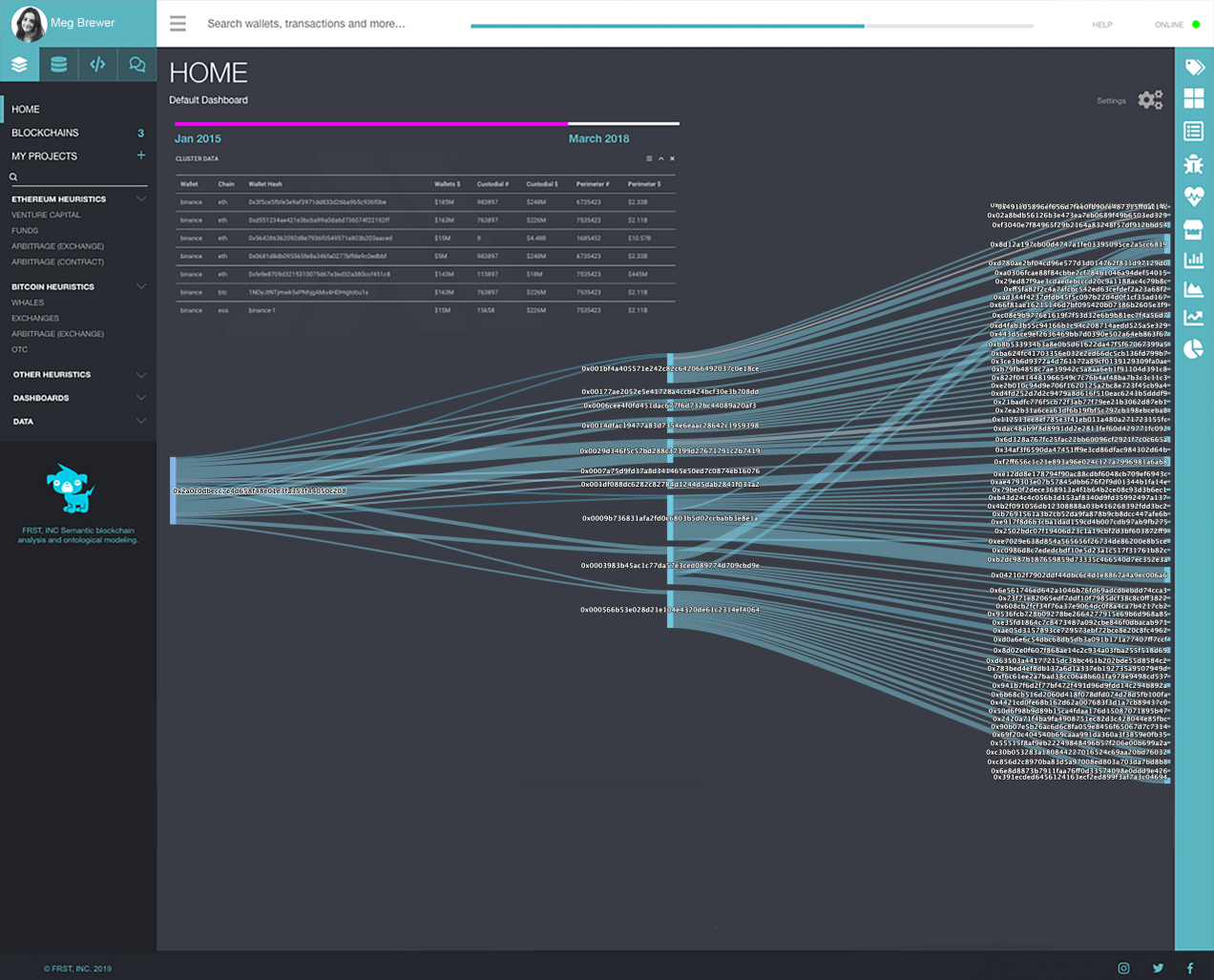

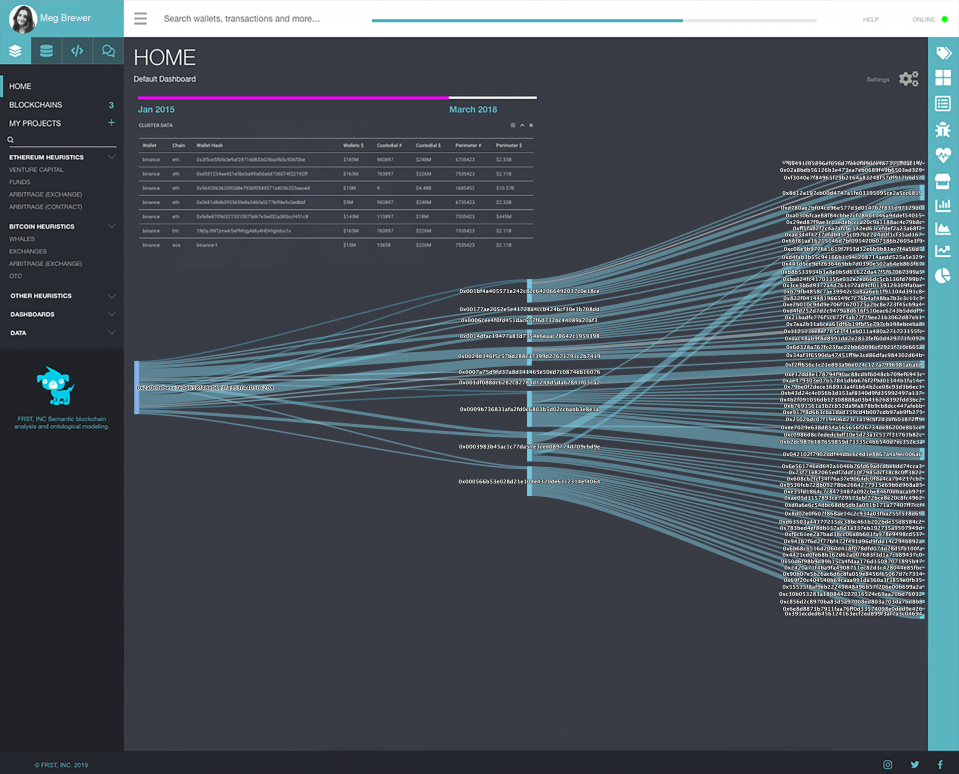

The more interesting question is what adoption of blockchain technology looks like, and that’s where people are placing bets right now. Useful, reliable data is key for greater adoption. That’s what we’re working to deliver with the FRST platform—an accurate and useful portrayal of the data being committed to the blockchain, to catalogue and organize everything and allow users to leverage that data in increasingly sophisticated ways.

We want people to get answers to any query, whether the user is looking for a specific Ethereum (ETH) sale for tax reporting or on-chain evidence of an internet of things(IoT)-equipped shipping container in the middle of the Pacific. We are supplying the raw materials for cutting-edge analysis, and we believe our users will apply them to craft analytics, alerts, trading signals, and audit processes we never could have anticipated.

Much has been made recently of Bitcoin’s 10th anniversary and how the digital asset space has changed in that time. What stands out to you about the now decade of history behind us?

I recently explored this very topic in my 2019 talk in Davos during the World Economic Forum.

It’s fun to imagine moments in this industry’s story that many in the audience weren’t there for, whether it’s Satoshi walking around with an early copy of the BTC (bitcoin) whitepaper, Laszlo Hanyecz paying 10,000BTC for two pizzas, or the early weeks of 2018. To do just this, I worked with a Chicago artist to illustrate the market’s evolution since 2008, which really seemed to resonate with those in attendance.

In some ways, what FRST does is about translation of financial data into storytelling—allowing traders and researchers to turn blockchain data into a narrative, turn addresses into people, turn a time series into a story. That’s what I saw in these illustrations—that although crypto has only been around for a decade, there is already an oral history, a mythology we share.

I think this first decade of blockchain has been about education and literacy. More people today understand appropriate use cases than ever before and they’re realizing that having data on chain is useful, from digitization of contract terms to audits of supply chain activity.

How are people learning about what’s going on “on chain” and “not on chain”? What data exist and how are they sourced?

Data on the blockchain is enormously important and valuable, but it is the metadata, or “data about data,” that makes the blockchain data more contextualized, interesting, and actionable.

I visualize the data in three strata. There is data that is on-chain, meaning contained in a block that was accepted by block producers. Then there is data about that data, which annotates on-chain data in our database—for instance, that a wallet is known to be affiliated with an exchange. Finally, there is data that requires translation or transformation to match up with blockchain data—FRST’s Crunchbase functionality that ties a wallet to that investor’s personification on Crunchbase’s website is a good example.

All three of these strata are focus areas at FRST though, like nearly everyone in the space, we began with on chain information and grew from there.

How are traders and investors making decisions about digital assets today?

Now you’re into my real area of interest—my PhD focused on frameworks for decision-making under uncertainty. How people make decisions is something I think of like a recipe. Our job at FRST is to provide all the ingredients you could possibly want to craft your decision-making recipe.

Maybe you need a sandbox in which to test trading algorithms against each other on historical data. Maybe you need a back-testing system that lets you compare the performance of portfolio allocations. Maybe you need pricing for thinly-traded niche assets. Maybe you need a catalogue of interesting or severe market events for resiliency testing of your current portfolio.

Our customers know more about their businesses and how they make decisions than we do. And they should—it’s their business, after all! Our job is simply to provide what they need to build, test, refine, and confidently execute the trading strategies they’ve crafted. And every day, we’re working to provide new variables for customers to integrate into models.

You teach at Northwestern University’s law school and your testimony has been cited by the SEC Commissioner, so you’re clearly thinking about the legal and regulatory aspects of digital assets. How should an investor approach issues like regulation, KYC, and asset provenance in this space?

Carefully!

It’s prudent for investors to be cautious and utilize the available tools, such as the known lists of bad actors and bad actor wallets. Investors may want to avoid dealing with niche exchanges that enjoy contractual, regulatory, or jurisdictional protections. There are best practices around KYC and AML, which have been vetted by experts and are not burdensome to follow. And there are ways to answer, and trace conclusively, provenance questions.

While we are not in a position to give legal advice, we regularly advise our customers on what is and is not technologically possible and can help them craft queries on our system to investigate the history of a transaction or a suspicious location on the network.

Powerful tools, including ours, can help an informed investor avoid dealing with bad counterparties or being taken by scams and schemes.

How quickly do you expect the digital asset market to mature?

It’s worth looking over our collective shoulders every now and then and pondering how far we’ve come. The options market is evolving, the regulatory picture is coming into focus, the market mechanisms many doubted are now working across different networks. Institutional investors who previously saw blockchain as a punchline now see it as an asset class. Some of the world’s top trading floors now have crypto desks and more are coming online every month. I’m not saying the market is mature, but I’m saying it’s maturing in real, observable ways.

What is your long view on blockchain technology and digital assets?

FRST’s office is a short walk from what was once one of the world’s largest open outcry trading floors. And it wasn’t that long ago that shouting humans were the state-of-the-art way of sending buy and sell signals. But trading tokens is merely one aspect of this exciting new technology.

I think the long view is one wherein much of what is today kept in proprietary databases is instead kept in blockchain environments—from the remaining balance on your subway card to your electronic medical records. You’ll see a management layer of advanced authentication and permissions while the structural safeguards of the chain underneath will be largely invisible.

We have a long way to go to reach that future, with many Fortune 500 firms unlikely to shut down their on-premises mainframes until well into the 2020s. But change is incremental and I believe many important steps are being taken today and many so-called “projects” on the blockchain today will, before long, become essential services upon which we rely.

FRST is running a “deep beta” aimed at onboarding a select group of institutional investors, hedge funds, and standalone trading floors for the next version of its platform. If you’d like to be considered for participation in this program, contact [email protected]. For more information about FRST, visit www.frst.com. Keep up with Karl on Twitter at @karlmuth.

Advertisement