Sustainable Energy

Does the Wind Production Tax Credit Matter?

The fledgling U.S. wind industry would be significantly set back if the credit isn’t renewed.

The fast-growing but still relatively tiny U.S. wind industry is in danger of suddenly spinning to a halt. Its fate will largely depend on whether or not a large federal subsidy for wind power producers, set to expire this year, is renewed. And whether or not the so-called renewable electricity production tax credit (PTC) is extended appears to depend on the outcome of the presidential election.

President Obama supports an extension, whereas Republican presidential candidate Mitt Romney has come out in support of letting the credit expire without renewal. One thing is clear: Without an incentive like the PTC, the U.S. wind industry would surely not continue to grow.

The policy was originally established in 1992 as part of an energy bill signed by President George H. W. Bush. It gave a tax credit of 1.5 cents per kilowatt-hour to generators of certain types of renewable electricity, including that from wind. The credit expired in July 1999, and since then has been renewed, expired, and been renewed again several times, with several months-long lapses in between. The rate has been adjusted for inflation and is now 2.2 cents per kilowatt-hour.

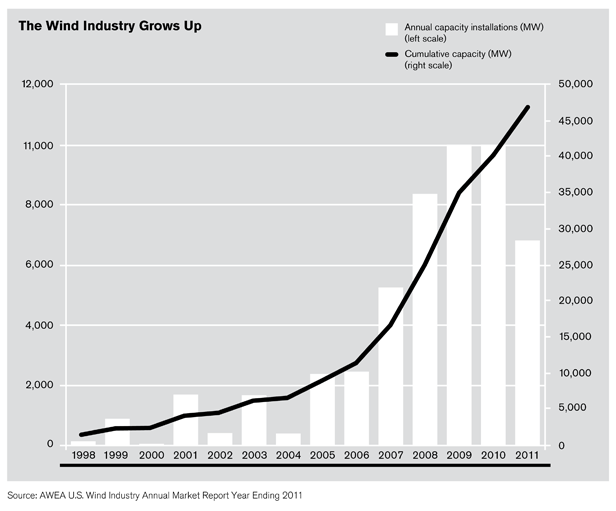

Federal subsidies like the PTC, along with state-specific renewable energy targets, have been the primary drivers of growth in the industry. Last week, the American Wind Energy Association said the U.S. has now surpassed 50 gigawatts of installed wind-generating capacity—up from 1.5 gigawatts just 14 years ago. (The total U.S generating capacity is over 1,000 gigawatts.) The importance of the PTC over time can be seen in the first chart. Although other factors were surely also at play, new installations lagged during the three years (2000, 2002, and 2004) in which the PTC lapsed.

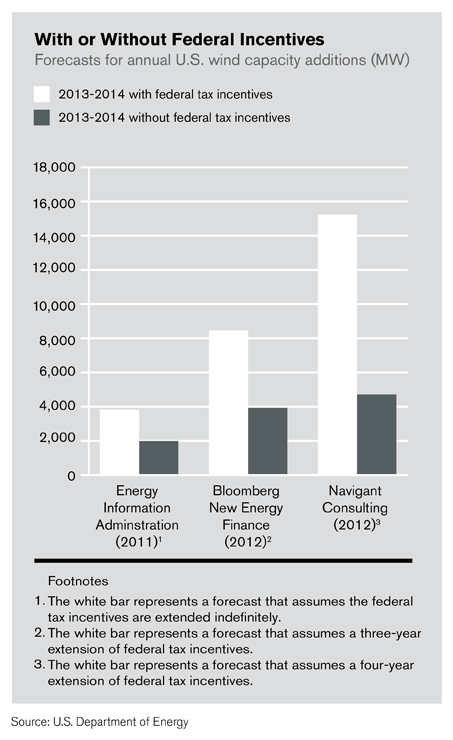

Analysts expect a record or near-record number of installations this year, as developers rush to take advantage of the PTC before it possibly disappears. The market uncertainty that would face the industry, together with low natural gas prices, could “dramatically” slow new installations starting next year, according to the U.S. Department of Energy. As shown in the second chart, market forecasters generally anticipate much lower wind capacity additions in the absence of federal tax incentives.