Tech’s biggest-ever takeover deal is now officially off the table, and there’s no shortage of speculation about what might happen next.

Dead deal: Broadcom withdrew its $117 billion offer to acquire Qualcomm this morning.

Next for Broadcom: It says it will continue with its plans to relocate its HQ to the US. (It’s worth noting that if it had done that sooner, it might have escaped the Committee on Foreign Investment in the United States review that ultimately led President Trump to block the deal.)

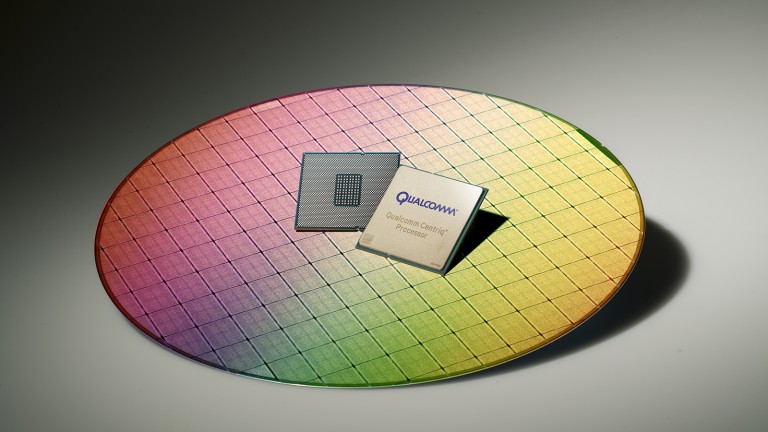

And for Qualcomm: It got what it wanted—it’s been trying to resist the takeover ever since Broadcom launched it. (It spent 100 times more in lobbying than Broadcom.) But the New York Times notes that it’s out of the frying pan and into the fire: the US Federal Trade Commission and Apple both claim that some of the company’s practices are illegal, and investors are unhappy about its performance. It will hope that a planned acquisition of Dutch chipmaker NXP can ease those latter concerns.

Part of a war: DealBook notes that the dropped deal could place Qualcomm in the midst of fierce governmental protectionism. The US government’s reason for nixing the Broadcom acquisition involved concerns that it could harm America’s lead in developing 5G wireless technology and allow China to seize control. The same anti-foreign feeling could affect Qualcomm’s NXP takeover and extend to other tech sectors as well.

Not for sale: As Bloomberg notes, if there’s one firm takeaway from this whole ordeal, it’s that the US has no plans for foreign firms to acquire its semiconductor businesses. Chip firms have been clamoring to acquire each other in recent years (to boost efficiency and, in turn, profit). America’s stance could make that more difficult.